Tips for Diversifying Your Nonprofits Funding Sources

Tips for Diversifying Your Nonprofit’s Funding Sources

In today’s rapidly changing philanthropic landscape, nonprofits face increasing pressure to ensure sustainability and resilience. Relying on a single funding source can leave your organization vulnerable to economic shifts, donor fatigue, and policy changes. That’s why diversifying your nonprofit’s funding sources is not just a smart move-it’s essential for long-term impact.

This guide explores actionable strategies for achieving financial diversity, highlights examples from leading organizations, and provides practical tips for diversifying revenue streams for nonprofits. Whether you’re a small grassroots group or an established foundation, these insights will help you build a more robust and adaptable nonprofit strategy.

Why Financial Diversity Matters for Nonprofits

Financial diversity means your organization draws income from a variety of sources. This approach:

Reduces risk if one funding stream dries up

Increases organizational independence

Enables greater flexibility in program planning

Builds trust with stakeholders and funders

According to Nonprofit Pro, nonprofits with multiple revenue streams are better equipped to weather financial storms and seize new opportunities.

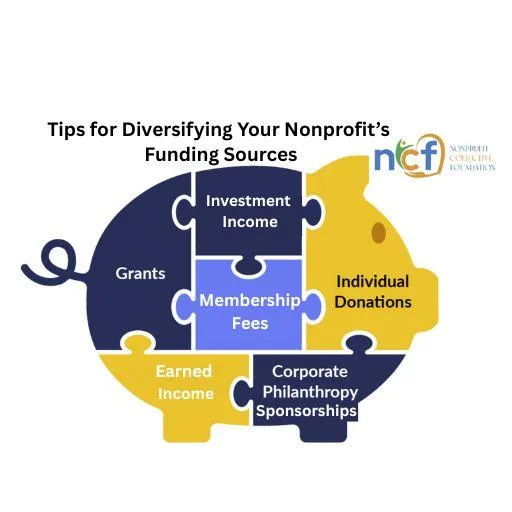

Primary Funding Sources for Nonprofits

Before diversifying, it’s important to understand the main types of funding sources available:

Individual Donations: Gifts from supporters, both one-time and recurring.

Grants: Funds from foundations, corporations, or government agencies.

Corporate Sponsorships: Support from businesses in exchange for recognition or partnership.

Earned Income: Revenue from selling goods, services, or event tickets.

Membership Fees: Dues from individuals or organizations for access to benefits.

Investment Income: Earnings from endowments or reserve funds.

Each source has unique benefits and challenges, and the right mix depends on your mission, capacity, and community.

Tips for Diversifying Revenue Streams for Nonprofits

1. Assess Your Current Funding Mix

Start by mapping your current income streams. What percentage comes from each source? Are you overly reliant on one? Use this data to identify gaps and opportunities.

For a step-by-step guide, see How to Conduct a Nonprofit Financial Health Assessment.

2. Cultivate Individual Donors

According to Giving USA, individual giving remains the largest source of charitable dollars in the U.S.

Utilize your email marketing or monthly newletters to build relationships by:

Telling compelling stories of impact

Offering multiple ways to give (online, monthly, planned gifts)

Recognizing and stewarding donors at all levels

3. Pursue Grants Strategically

Grants can provide significant funding, but they’re competitive and often restricted. Increase your success by:

Researching funders aligned with your mission on sites such as Foundation Directory Online)

Tailoring proposals to each grantmaker’s priorities

Building relationships with program officers

4. Develop Earned Income Opportunities

What is Earned Income for a Nonprofit Entity?

Glad you asked…earned income for nonprofits is any revenue generated from activities, products or services related to your mission. This does not include donations or grants. Some examples would be:

Selling products like merchandise

Fees for a service like an educational/training course or workshop

Membership dues

Income from renting out office or venue space

Ticket sales for events, performances or conferences

Keep in mind nonprofit earned income can be taxable and there are a rules and regulations for accepting this type of revenue and maintaining 501(c)3 status. You can find a great article on Nonprofit Earned Income here.

Examples of financial diversity for nonprofits:

A theater company selling tickets and concessions

An animal shelter offering pet training classes

An advocacy group publishing paid research reports

5. Engage Corporate Partners

Corporate support isn’t limited to sponsorships. Explore:

Employee giving programs

Matching gifts

Cause marketing campaigns

In-kind donations

Build partnerships that align with your values and offer mutual benefits.

6. Launch a Membership Program

If your mission lends itself, create a membership structure. Offer exclusive content, discounts, or networking opportunities to incentivize joining.

7. Explore Investment Income

If you have reserves or an endowment, responsible investing can generate additional income. Consult with financial advisors to align investments with your values and risk tolerance.

Building a Resilient Nonprofit Strategy

Diversifying funding sources is more than a financial tactic-it’s a core element of a resilient nonprofit strategy. Here’s how to make it part of your organizational culture:

Set clear goals: Define what financial diversity looks like for your organization (e.g., no single source exceeds 30% of revenue).

Engage your board: Involve board members in fundraising and networking.

Invest in capacity: Build staff skills in grant writing, donor relations, and business development.

Monitor and adapt: Regularly review your funding mix and adjust as needed.

A Case Study: Unlocking Stability through Nonprofit Revenue Diversification

The Nonprofit Collective Foundation is as follows:

Other Examples:

Habitat for Humanity: Combines donations, grants, and proceeds from ReStores (thrift shops).

Girl Scouts of the USA: Earns significant income from cookie sales in addition to donations and grants.

YMCA: Balances membership fees, program income, donations, and government support.

External Link: For more examples, see National Council of Nonprofits: Revenue Mix.

Overcoming Common Challenges

Diversifying revenue streams for nonprofits isn’t without hurdles:

Capacity constraints: Small teams may lack time or expertise.

Mission drift: Chasing income can distract from core purpose.

Donor concerns: Some supporters may prefer “pure” funding sources.

Solutions:

Start small-pilot one new funding source at a time.

Align new activities with your mission and values.

Communicate transparently with stakeholders about your strategy.

Measuring Success

Track your progress by monitoring:

The percentage of revenue from each source

Year-over-year growth in new streams

Donor and funder retention rates

Impact on program delivery and sustainability

Use dashboards or financial software to visualize your funding mix and share results with your board and supporters.

Conclusion

Diversifying your nonprofit’s funding sources is a journey, not a one-time project. By embracing financial diversity, your organization can weather uncertainty, seize new opportunities, and maximize impact. Start by assessing your current funding mix, set clear goals, and experiment with new revenue streams that align with your mission.

Remember, every step toward financial diversity for nonprofits strengthens your organization and the communities you serve.

Ready to take the next step?

Explore more resources on Nonprofit Strategy and Financial Management or contact us for a personalized consultation.

Want more tips? Subscribe as a Nonprofit Associate or email us today at info@TheNonprofitCooperative.orgfor the latest on nonprofit strategy and financial diversity!

This article is for informational purposes only. For tailored advice, consult a nonprofit financial expert or advisor.